Bank of England base rate

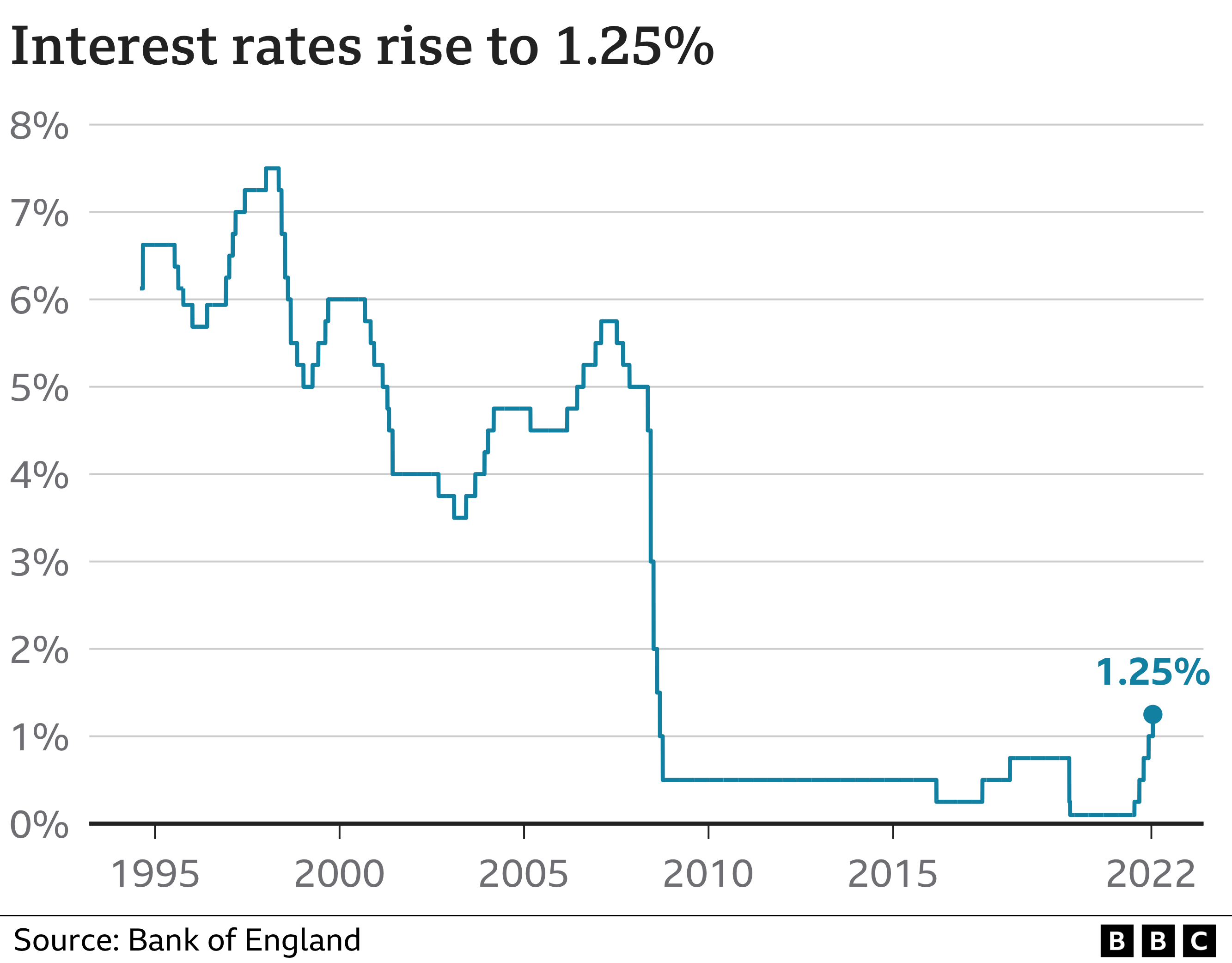

In August the BoE raised its main interest rate by 50 basis points taking it to 175 in its largest move in 27 years. The Bank of England base rate is currently 175.

Ad Talk To Us About Taking Advice - Financial Advice Thats Always On Your Terms.

. LONDON July 26 Reuters - The Bank of England BoE will likely shy away from a bigger interest rate rise in August and instead stick to the more. The overwhelming majority of economists in a Sept. If you have a problem or question relating to the database please contact the DSD EditorReference Id 18342055902.

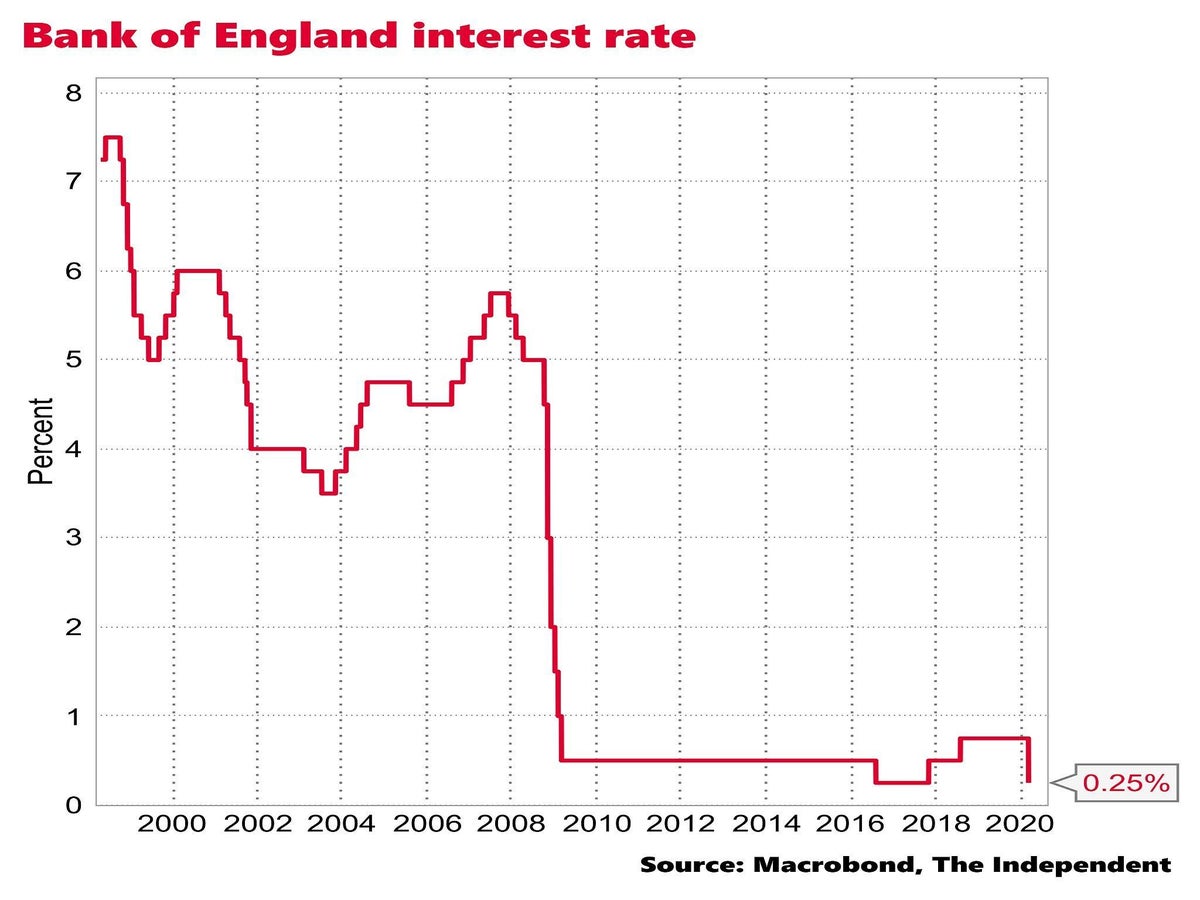

It is the base rate of. The global financial crisis causes the UK interest rate to drop to a low. The Bank of England BoE is the UKs central bank.

The key difference between bank rate and base rate is that the bank rate is the rate at which the central bank in the country lends money to commercial banks while base rate is. Continue reading to find out more about how this could affect you. Our mission is to deliver monetary and financial stability for the people of the United Kingdom.

Then in August 2018 the Bank of England raised the bank. Base rate raised by 05 percentage points to 175 as Bank says inflation will hit 13 in October 0046 An uncomfortable situation. Book Free Call Back From Our Advisory Helpdesk To Determine If Advice Is Right For You.

18 hours agoLONDON The Bank of England voted to raise its base rate to 225 from 175 on Thursday lower than the 075 percentage point increase that had been expected by many. This rate is used by the central bank to charge other banks and. Bank of England says UK will enter.

In a bid to minimize the economic effects of the COVID-19 pandemic the Bank of England cut the official bank base rate in March 2020 to a record low of 01 percent. The base rate was increased from 125 to 175 on 4 August 2022. The base rate dropped to an all time low of 01 following the outbreak of the coronavirus pandemic in March 2020.

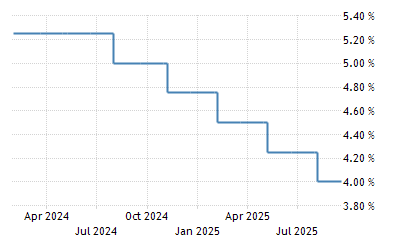

That would mean an interest rate of 35 to 4 - well above the 25 peak priced in by financial markets for June 2023. As of 08152022 EDT. 47 rows The Bank of England base rate is the UKs most influential interest rate and its official.

Posen who is now the president of Washingtons. The current Bank of England base rate is 175. The Bank of England has increased the base rate to 175 from 125 - the biggest single rise in 27 years.

The base rate is effectively increased over the next few years to combat high inflation. The Base Rate is the interest rate set by the Bank of England and is also known as the official Bank Rate. The Bank of England Base Rate BOEBR also known as the official bank rate is the rate of interest charged by the BoE to commercial banks for overnight loans.

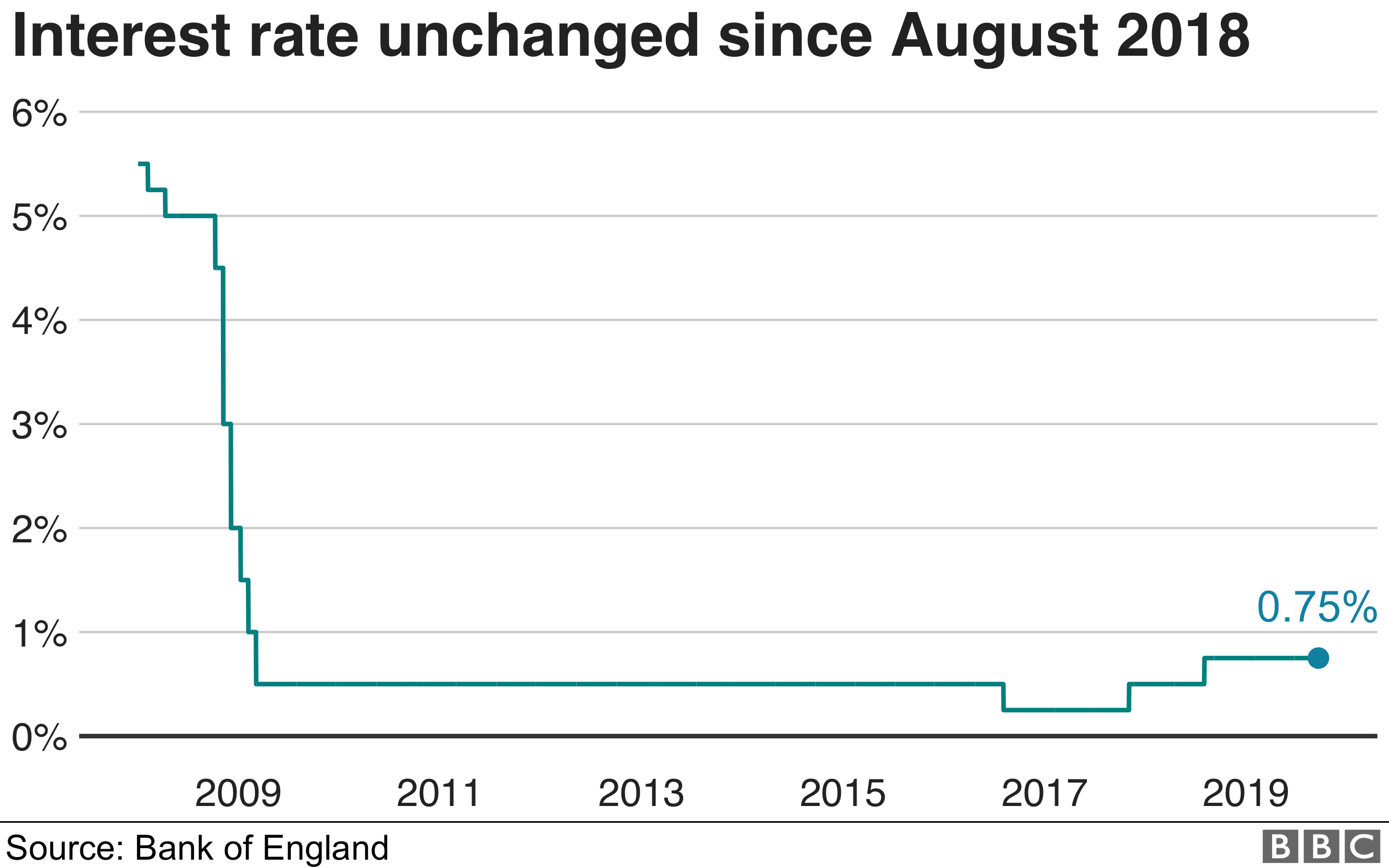

The base rate was previously reduced to 01 on 19. UK Bank of England Official Bank Rate. The Bank of England finally raised interest rates in November 2017 for the first time in over a decade back to 05.

In a development that will heap renewed pressure on mortgage holders the Banks key base rate is expected to reach 4 by May 2023 according to the path implied by financial.

Why Have Interest Rates Been Slashed And What Will The Impact Be The Independent The Independent

How The Bank Of England Set Interest Rates Economics Help

Uk Interest Rates Raised To 1 25 By Bank Of England Bbc News

Bank Of England Forecasts Low Interest Rates For Longer Bbc News

Comments

Post a Comment